Income with US withholding tax from US securities

Investors are subject to a U.S. withholding tax rate of 30% on income or dividends from U.S. securities. According to the double taxation agreement between the Federal Republic of Germany and the United States of America, a reduction of this withholding tax to 15% for dividends and up to 0% for interest is possible. This also applies to most other EU countries. If you are resident outside the EU, a different withholding tax rate may apply.

The reduction of the withholding tax can be applied for by means of an appropriate US tax form. This form must already be available at the time of a corresponding income or dividend statement. Unfortunately, US tax forms submitted subsequently cannot be taken into account.

Initial registration and data collection

At Opening a CapTrader deposit all non-U.S. persons and entities must complete an IRS Form W-8 to confirm their country of tax residence and clarify whether a reduced withholding rate applies to them. W-8 forms are not submitted to the IRS.

In the online account application, the W-8 form is automatically filled out for you, so you don't need to fill out any additional documents here!

Important: Provided you keep all personal data in the account management (Client Portal) up to date, this form will remain valid. Every three years you will be asked to check the information in the W-8 once and confirm that it is up to date. The updates made during the calendar year will then apply retroactively to the beginning of the year.

Update of the W-8 form

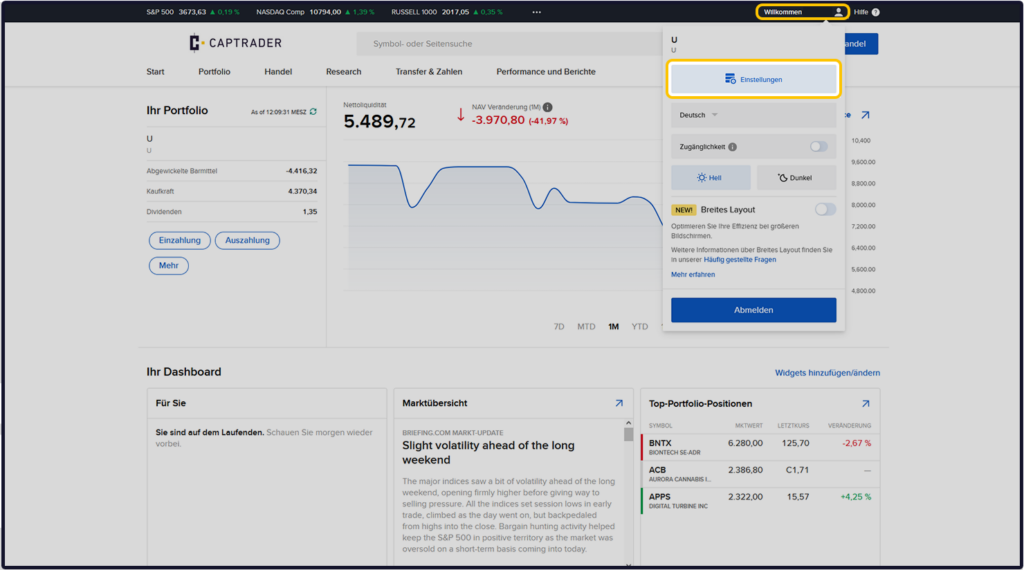

Sign up in the Account Management (Client Portal) and click in the upper right corner on the > User icon and then on > Settings.

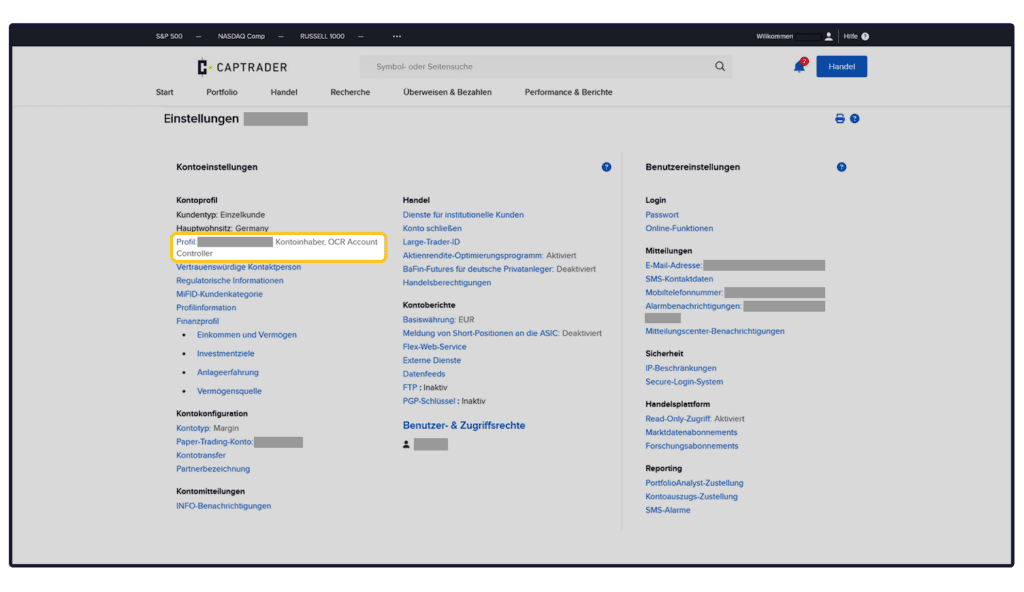

Now click on the left-hand side under the menu item > Account profile to > Profile or your name to check or adjust your stored information.

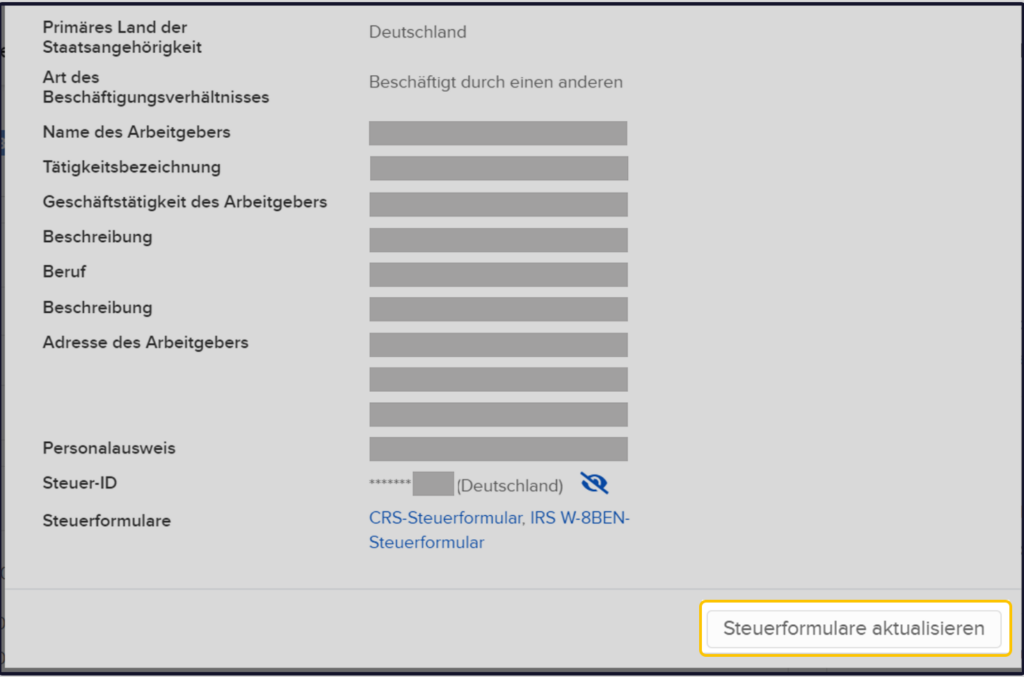

Then at the end of the form select the button > Update tax forms.

You will now see the information already stored at CapTrader. Please update them if there were any changes in your information. If nothing has changed, without changing the information, please click on the button > More.

After that, the W-8BEN form will be automatically filled with your previously provided information.

Do you have a US tax number?

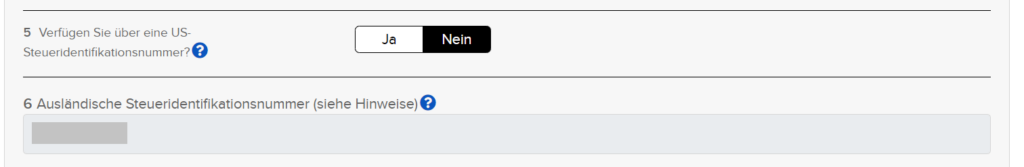

If you also have a US tax identification number, please enter it in field 5. After a click on > YES the number can be noted there.

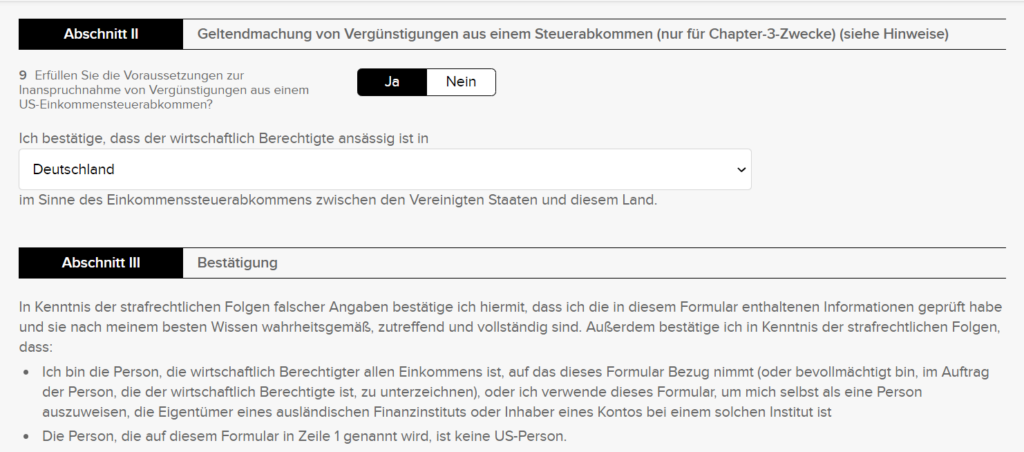

In section II, point 9 you can see your tax residence. Please check this for correctness and adjust it here if necessary.

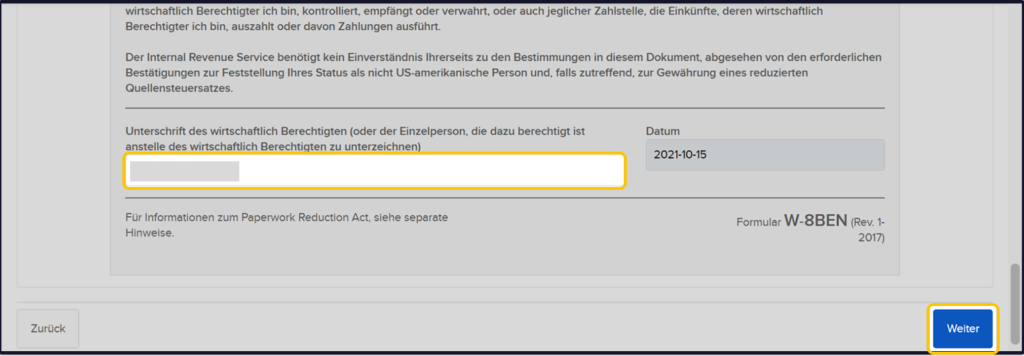

At the end of the form, confirm the information by entering your digital signature in the empty field. Then click on the button > More.

Note: Please note that your signature is case sensitive.

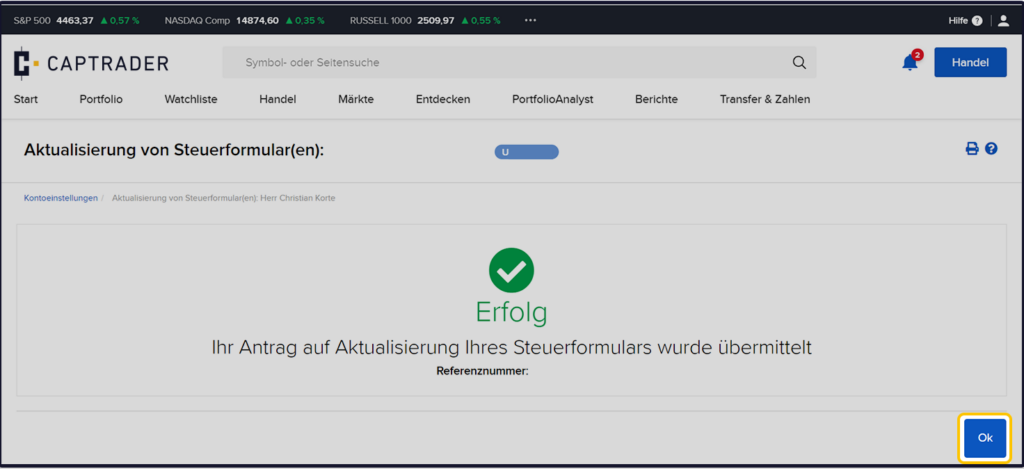

The process is now completed with the display of the SUCCESS page. Please click the button to exit > OK.

More information

The Foreign Account Tax Compliance Act (FATCA; see www.irs.gov/fatca) requires foreign financial institutions (FFIs) and foreign financial institutions deemed to be FATCA compliant to identify their account holders to the Internal Revenue Service (IRS, U.S. tax authority that regulates and monitors compliance with the FATCA law). Account holders (natural persons; U.S. citizens and Non-U.S. citizens) who do not disclose their status for purposes of potential tax liabilities are subject to the full 30% tax withholding on U.S. source income.

Tax identification number

Every citizen of the Federal Republic of Germany, or every person registered in Germany, was assigned a personal tax identification number and notified by means of a personal information letter.

Business customers

When opening a company deposit for corporate entities (limited liability company or a joint stock company), the W-8BEN must be completed by the legal entity and by each shareholder.

For more information, please visit the Website the U.S. Internal Revenue Service (IRS).

In general, it is recommended to clarify individual questions with your tax advisor.